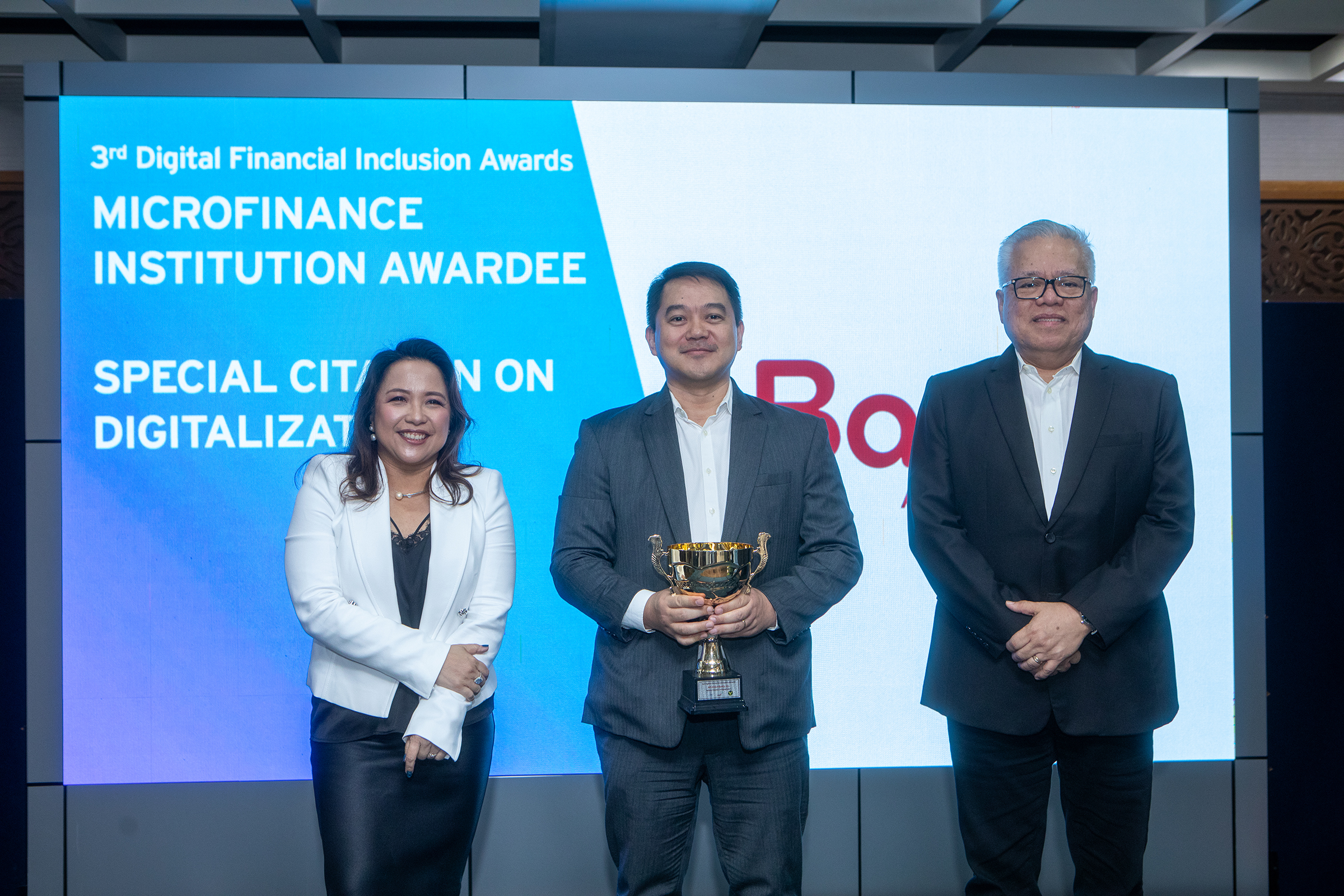

In photo: Rod Mabiasen, Jr., BanKo President (center) with members of the National Selection Committee (L-R): Salve Duplito, Financial Trainer and Adviser; and Ramon Lopez, SM Investments Corporation Independent Director and Former Secretary of the DTI.

BPI Direct BanKo, Inc., A Savings Bank (BanKo), the microfinance arm of the Bank of the Philippine Islands (BPI), received a special citation for its pioneering digitalization efforts at the 3rd Digital Financial Inclusion Awards (DFIA).

Supported by the Bangko Sentral ng Pilipinas (BSP) and organized by the Microfinance Council of the Philippines, Inc. (MCPI) in partnership with Citi Foundation, DFIA honors microfinance institutions and micro- entrepreneurs who have transformed businesses and communities through remarkable digitalization. BanKo was one of the four microfinance institutions (MFIs) recognized in the awarding ceremony.

“We are grateful to the BSP and MCPI for this recognition. BanKo’s journey exemplifies the transformative power of digital solutions in driving financial inclusion, helping Filipinos thrive in the digital age,” said Rod Mabiasen Jr., BanKo President.

“By providing accessible and innovative products, we will continue to help our clients, especially the self-employed micro-entrepreneurs (SEMEs), take control of their financial well-being and build a better future. Dahil dito sa BanKo, may ngiti ang bukas mo,” Mabiasen added.

BanKo continues to champion digital financial inclusion, empowering Filipinos with accessible solutions that bridge the gap to a more inclusive financial future.

BanKo continues to redefine banking by enhancing and expanding its digital touchpoints. With the BanKo Mobile App, customers gain access to a variety of services, including interbank money transfers, bill payments, and loan management. With the straight through onboarding facility of the app, more Filipinos can open PondoKo or TODO savings account within a few minutes. PondoKo provides an interest-bearing basic deposit account with no maintaining balance, while TODO offers 5% annual interest rate.

Through its flagship NegosyoKo Loan, BanKo has also transformed lending for SEMEs, offering convenient and affordable access to vital capital ranging from Php 15,000 to Php 500,000, with flexible tenors spanning six to 60 months. A borrower can initiate loan application and loan re-availment at the comfort of her store via BanKo Mobile App and the BanKo Loan Application Portal.

In 2024 alone, BanKo disbursed over Php 21 billion in loans to more than 200,000 SEMEs, marking a significant 53% growth in its loan portfolio. This achievement solidifies BanKo’s position as one of the country’s largest microfinance banks.

Now with 369 branches and branch-lite units, situated in 77 out of 82 provinces nationwide, BanKo leads in digital financial inclusion, driving economic empowerment and sustainable growth across the Philippines.

###