- Asks Congress to repeal the measure

- Says it is oppressive and inequitable

By Ivy Tejano

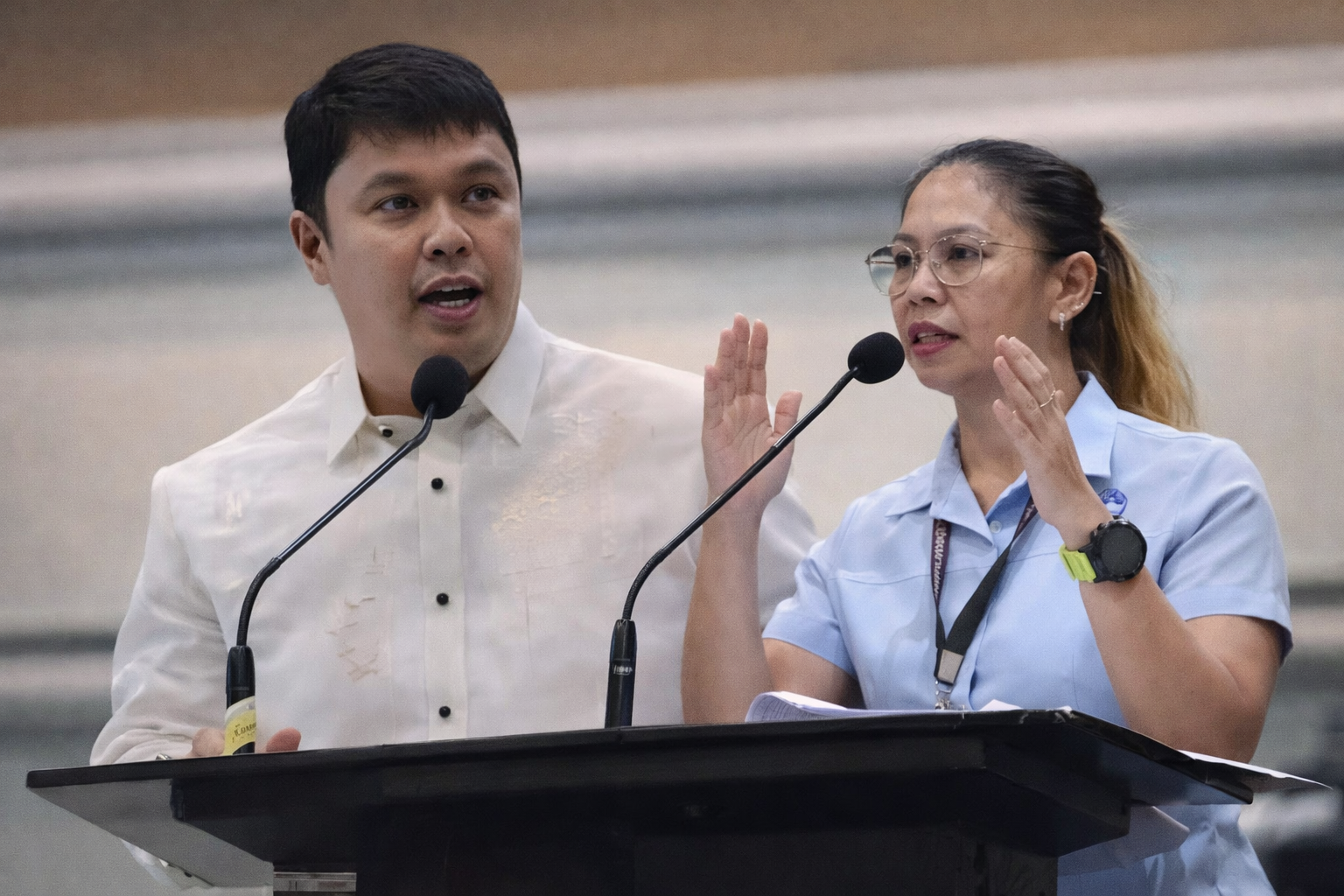

DAVAO CITY – A lawmaker here filed a resolution strongly opposing the imposition of a 20% final withholding tax on interest income from bank deposits, a provision under Republic Act No. 12214, also known as the Capital Markets Efficiency Promotion Act (CMEPA).

The controversial provision, which takes effect on July 1, 2025, mandates a uniform 20% tax on all interest income from bank deposits, regardless of currency denomination or deposit maturity.

Councilor Danny Dayanghirang’s resolution denounced the measure as unfair, particularly for low- and middle-income Filipinos, and retirees who rely on modest interest earnings from savings for long-term needs such as retirement, education, emergencies, and business capital.

“Some modest interest that Filipinos may earn on these savings critically helps depositors preserve the value that their money has amid inflation and rising cost of living,” said Dayanghirang, who heads the Committee on Finance, Ways and Means, and Appropriations.

Dayanghirang emphasized that taxing interest on savings at a flat rate is “oppressive” and “inequitable,” especially in the context of existing financial burdens such as inflation and numerous other taxes and surcharges.

“This blanket taxation removes previous exemptions for long-term deposits and discourages saving behavior. It punishes those who are financially careful, rather than encouraging savings and responsible investment,” the councilor said.

Dayanghirang expressed concern that the law could damage public trust in the banking system and undermine the financial security of middle-income earners and retirees.

The resolution calls on Congress to review, amend, or repeal the relevant provisions of CMEPA. It urges lawmakers to explore alternative taxation models that are fairer and more inclusive of low- and middle-income savers.

Finally, the resolution appeals to the Department of Finance and the Bureau of Internal Revenue to suspend the implementation of the tax policy until proper public consultations and legislative reviews are conducted.

The resolution will spark further debate in local and national government circles. Dayanghirang said the move highlights growing public concern over tax burdens and their impact on financial inclusion and personal savings.